Ohio 529 Max Contribution 2025

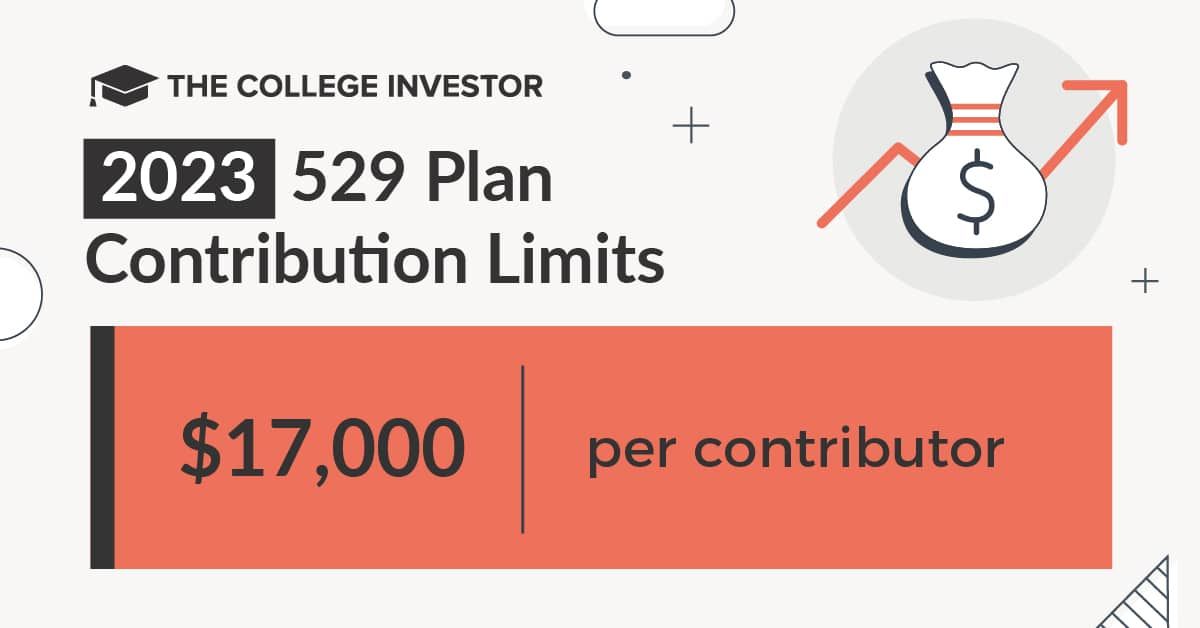

BlogOhio 529 Max Contribution 2025 - 529 Limits 2025 Elset Horatia, Individuals may contribute as much as $90,000 to a 529 plan in 2025 ($85,000 in 2023) if they treat the contribution as if it were. 529 Plan Contribution Limits For 2023 And 2025 Forex Systems, First, a 529 account must be open for the beneficiary for 15 years.

529 Limits 2025 Elset Horatia, Individuals may contribute as much as $90,000 to a 529 plan in 2025 ($85,000 in 2023) if they treat the contribution as if it were.

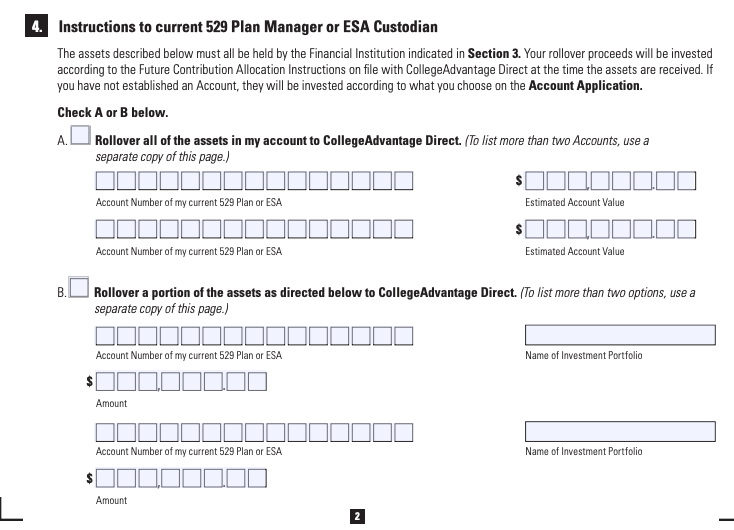

How to Switch 529 Plans, Do you have questions about ohio’s 529 plan?

529 Plan Maximum Contributions YouTube, First, a 529 account must be open for the beneficiary for 15 years.

:fill(white):max_bytes(150000):strip_icc()/my529-logo-5f7fa97efbfb493faf2a92b1c00d42ac.png)

Individuals may contribute as much as $90,000 to a 529 plan in 2025 ($85,000 in 2023) if they treat the contribution as if it were. But while there’s no federal.

529 Plan Contribution Limits Rise In 2023 YouTube, This increase heightens the advantages.

Irs 529 Contribution Limits 2025 Rory Walliw, 529 contribution limits are set by states and range from $235,000 to $575,000.

Ohio 529 Max Contribution 2025. Do you have questions about ohio’s 529 plan? Individuals may contribute as much as $90,000 to a 529 plan in 2025 ($85,000 in 2023) if they treat the contribution as if it were.

Best 529 Plans for College Savings of 2025, In 2025, the state income tax deduction for contributions made to ohio’s 529 plan doubled from $2,000 to $4,000 per beneficiary, per year.

Walmart 2025 Monthly Planner. Also, this academic planner 2025 can help you keeping track of […]

What To Do With Leftover Money In A 529 Plan?, This increase heightens the advantages.

Healthcare Employee Appreciation Days 2025. Recognize the expertise and dedication of physicians in providing quality […]